Backtesting.py 是 Python 下的一个回测框架,但是你不用需要在他的类里实现什么指标。基本上你只需要加载历史数据,然后转换成 pandas 的 dataframe,然后用 pandas_ta 这个库计算指标和信号,然后再在 Backtesting.py 的策略类实现信号买卖就可以了。

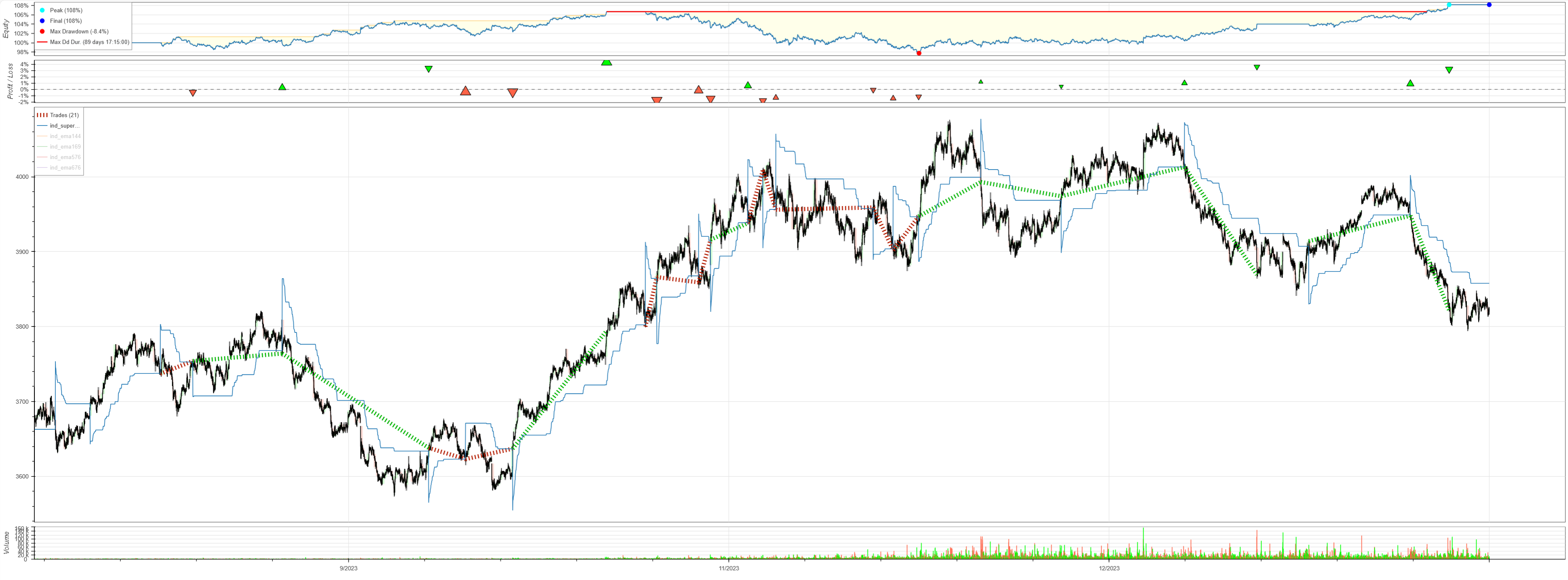

螺纹钢2405 5 分钟图的简单回测

弄一个简单的 supertrend 策略,添加了止盈和止损。

- 最大收益 108%

- 最终收益 108%

- 最大回撤 -8.4%

- 历时 89 天

- 21 笔交易,包括多空

- 绿色是成功的交易段

- 红色是失败的交易段

Start 2023-08-17 21:35:00+08:00

End 2024-02-07 11:25:00+08:00

Duration 173 days 13:50:00

Exposure Time [%] 78.8

Equity Final [$] 108185.079963

Equity Peak [$] 108185.079963

Return [%] 8.18508

Buy & Hold Return [%] 4.480874

Return (Ann.) [%] 18.295331

Volatility (Ann.) [%] 12.531943

Sharpe Ratio 1.459896

Sortino Ratio 2.518898

Calmar Ratio 2.182325

Max. Drawdown [%] -8.383414

Avg. Drawdown [%] -0.462499

Max. Drawdown Duration 84 days 17:30:00

Avg. Drawdown Duration 2 days 13:01:00

# Trades 21

Win Rate [%] 47.619048

Best Trade [%] 4.325431

Worst Trade [%] -1.802946

Avg. Trade [%] 0.380934

Max. Trade Duration 25 days 12:55:00

Avg. Trade Duration 6 days 12:46:00

Profit Factor 1.797981

Expectancy [%] 0.396803

SQN 0.961494

_strategy MyStrategy

_equity_curve Equity Draw...

_trades Size EntryBar ExitBar EntryPrice Exi...from backtesting import Backtest, Strategy

from backtesting.lib import crossover

def ind_supertrend(data):

supert = ta.supertrend(

data.High.s, data.Low.s, data.Close.s, length=10, multiplier=10

)["SUPERT_10_10.0"]

return supert

class MyStrategy(Strategy):

def init(self):

self.supert = self.I(ind_supertrend, self.data)

def next(self):

price = self.data.Close

atr = self.data.ATRr_14

if crossover(price, self.supert):

self.position.close()

sl = price - atr * 10

tp = price + atr * 25

self.buy(sl = sl, tp = tp)

elif crossover(self.supert, price):

self.position.close()

sl = price + atr * 10

tp = price - atr * 25

self.sell(sl = sl, tp = tp)

bt = Backtest(

df_new, # df_new 是要加载 OHLCV 数据及指标数据

MyStrategy,

cash=100_000,

commission=0,

hedging=True, # 可做空

#exclusive_orders=True,

trade_on_close=True,

)

stats = bt.run()

bt.plot()

stats.to_frame()

pd.options.display.max_columns = None

pd.options.display.max_rows = None

stats._trades这个是按着涨跌比例来赚钱,不是商品期货的涨跌点,也无杠杆,所以只需要检验策略的胜率和回撤即可。

参考

- https://github.com/kernc/backtesting.py/blob/master/doc/examples/Quick%20Start%20User%20Guide.ipynb

- https://greyhoundanalytics.com/blog/custom-indicators-in-backtestingpy/

- https://www.youtube.com/watch?v=k6i903uNZ6E

- https://github.com/cgohlke/talib-build/releases

- https://kernc.github.io/backtesting.py/doc/backtesting/backtesting.html#backtesting.backtesting.Trade

- https://github.com/zunda-lab/fx_backtest/blob/main/src/unit_backtesting.py#L67

- https://qiita.com/TKfumi/items/4744f34a10863f0d3cfb

- https://qiita.com/TKfumi/items/ffb617898211a794bf9e

- https://qiita.com/TKfumi/items/17301ca962a0da9fcbce

- https://github.com/mpquant/MyTT

- https://gitee.com/wkingnet/stock-analysis/blob/master/func_TDX.py